Sooner or later, Advantis Credit will try to make contact with you. It’s useful to know your rights when dealing with debt collection agencies. Call Refresh Debt Services today and we will be able to help you find the right solution by discussing a number of different options available to you. Alternatively, you can complete the form on this page to request a call-back.

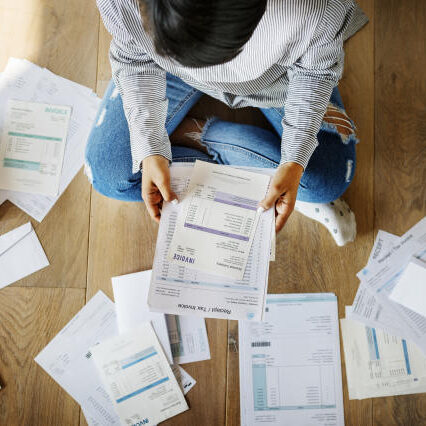

Remember to keep a copy of any letters and emails Advantis Credit send to you. Within these letters, you will find important information such as account balances and reference numbers.

Debt collection agencies like Advantis Credit also like to send their customers lots of automated letters. These automated letters will ask you to call them to set up a repayment plan for any unpaid balances.

As the debt collection process continues to happen, if you’re unable to reach an agreement, Advantis Credit may offer you an out of court settlement to settle the balance due. Debt recovery companies attempt to make things difficult with threats of court action. However, this will really depend on what type of debts you owe, as well as the total amount owed.

Remember that the letters and emails Advantis Credit send you will be mostly automated. A very similar standardised letter/email will also be sent out to anyone that Advantis is trying to recover any unpaid debt from.

It can be difficult to agree a suitable repayment plan with debt collection agencies such as Advantis Credit. Here at Refresh, we will take into account your current personal and financial circumstances before we help you find the right wider financial solution. Our specialist money advisors take a look at what you can realistically afford to pay each month, ensuring that any payment plan we set up for you is both manageable and realistic. These solutions are based upon your household income and expenditure details, allowing you to make the right decision when taking the first steps to become debt free.

If you have ever been contacted by Advantis Credit or any other debt collection agency, call Refresh Debt Advice today to speak to a specialist advisor. We provide free impartial advice and guidance. We can advise on a number of solutions that will help you become debt free.