If you’ve defaulted on payments to creditors, at some point, debt collection recovery agencies like BW Legal will try to contact you. Knowing your rights and how to deal with BW Legal when they make contact can be very useful. Speak to an expert advisor at Refresh today to discuss what options and solutions are available to you. Alternatively, you can complete the form on this page and an advisor will be able to call you at your convenience.

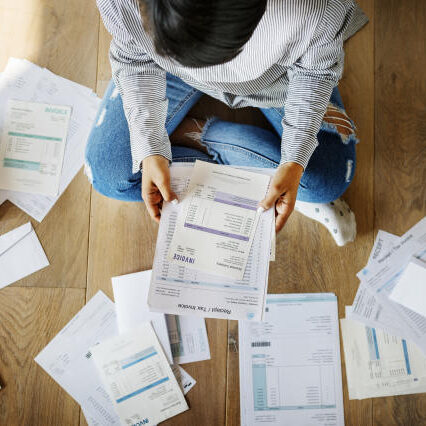

It’s important that you ensure you’re keeping copies of any emails and letters BW Legal send your way. This is because these letters and emails will contain useful information about how much you owe on each account as well as reference numbers.

You will most likely be sent many automated letters from BW Legal. Debt collection agencies will use these automated letters to request that you call them and make arrangements for a repayment plan for any outstanding debt.

If your financial circumstances hinder you from reaching a suitable agreement, debt recovery companies like BW Legal could potentially offer you an out of court settlement to settle the debt. They will try and attempt to make things difficult for you with further threats of court action. However, this ultimately depends on the type of debts you have, and what the outstanding balance is for each account.

Remember that most of these standardised letters sent by BW Legal will be automated. A similar letter will also be sent to any customer that BW Legal are attempting to recover any outstanding debt from. The only minor differences will be creditor names and the balance owed.

Agreeing to a repayment plan with debt collection companies such as BW Legal can often be difficult. The friendly team at Refresh Debt Services are able to consider your financial and personal circumstances before explaining what options and wider financial solutions are available to you. Our expert advisors look at your affordability, ensuring that any repayment plan we arrange is suitable. The range of wider financial solutions available to you are based on your household income and expenditure figures. Ultimately helping you make an informed decision when you take the first steps to becoming debt free.

If you have ever been contacted by BW Legal or any other debt collection agency, contact Refresh today to speak to a specialist advisor on 0800 121 48 63 or complete the online form on this page to request a call-back. We provide free impartial advice and guidance.