Easter Money Saving Tips: Spend Less, Enjoy More

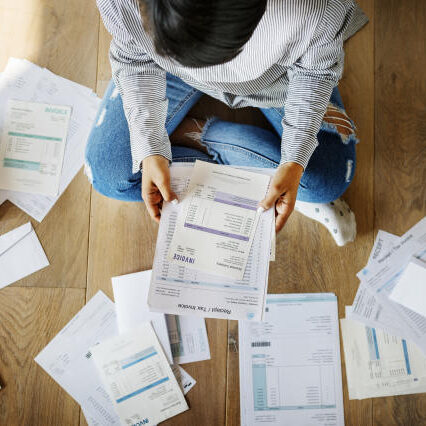

Easter is a time for family, food, and a bit of a breather – but it can also bring unexpected costs. Between school holidays, days out, chocolate eggs and big meals, it’s easy to overspend without realising. To help you stay on track, we’ve pulled together some practical Easter money saving tips so you can…