Don’t ignore their phone calls and letters to start with. This could make the situation worse, as they will be more likely to proceed with further action.

At this stage, it is important to know what your rights are and what you should do when Capquest debt recovery start their collection process. We’re able to help you resolve this situation by discussing a variety of wider financial solutions that are available to you.

Debt collection agencies such as Capquest will send you many automated and standardised letters. They will ask you to contact them by phone to set up a suitable arrangement. Sometimes, they may even try to threaten you with a visit to your property.

Later down the line, Capquest Debt Recovery could potentially offer you an out of court settlement. The situation can become less manageable when they start making threats to take you to court to obtain a county court judgement (CCJ), depending on your circumstances, in some instances, they could make you bankrupt.

It’s important to remember that these are automated letters, a similar letter will be sent to everyone Capquest are trying to recover unpaid debt from.

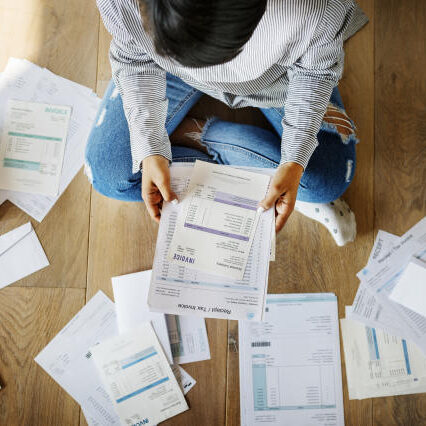

For many, it can be difficult to come to a suitable arrangement when setting up a repayment plan with Capquest Debt Recovery. We can help you find a solution that’s right for you by looking at what you can realistically afford to pay each month. We take into account details of your current financial situation by running through a household income and expenditure with you. This looks at what money you’ve got coming in and where that money is being spent, this information will help us to advise you on the most suitable option.

Have you been contacted by Capquest Debt Recovery? If yes, contact Refresh Debt Services to speak to one of our friendly advisors today for free impartial advice. We’re able to advise on a range of solutions, helping you become debt free.